If your neighbors have ever announced, "We go to the lake house every year the week after Memorial Day!" they might be on a fixed-week timeshare. Naturally, if you want to try a different week of the year, you're up a creek. Altering your designated week could take an act of Congress (or a minimum of a significant upgrade charge). The floating week choice permits you to select your week within specific limits. The offer would be something like, "You can reserve any week in between January 2 through May 4. other than for the two weeks prior to and after Easter." Each appointment also needs to be made throughout a specific window of time.

" Remember: first come, first served!" If you miss out on the window and get stuck to some random week in the dead of winter season, that's just difficult! A points system is another way you can get timeshare access nowadays, Additional hints likewise called a "timeshare exchange program." It essentially works like this: Your timeshare deserves a certain number of points, and you can use those points (together with the periodic extra fees) to access other resorts in the very same system. You need to be careful though. A mountain cabin timeshare in Tennessee doesn't cost the very same amount of points as a Walt Disney World Resort timeshare.

If this still sounds like a lot, let's not forget to discuss the considerable amount of costs connected with these bad young boys. First, you'll have the in advance purchase rate that averages over $22,000. If you don't have that cash saved already, you'll probably be looking for a loan (which you shouldn't do anyhow). However banks won't give you a loan to buy a timeshare. That's due to the fact that if you default on their loan, they can't go and repossess a week of getaway time! However do not worry. Your new good friends at the timeshare company will come to the rescue with a hassle-free method to fund your impressive purchase! Considering that they know you have so couple of alternatives for financing, they can charge outrageous interest ratestypically 14 to 20%.

What tends to slip up on you after that are the extra costs after the preliminary purchase. Uncontrollable maintenance fees run an average of $980 annually and go up around 4% each year. And if that's insufficient, include HOA dues, exchange fees (when you do not have sufficient points for that beach condominium), and the "unique assessments" for any repair work made to your system. With all those bonus, the total cost can drain your savings account quicker than that Nigerian prince emailing you for money! Let's say your initial timeshare purchase is that average price of $22,000 with the annual upkeep fee of $980.

All About Why Would You Ever Buy A Timeshare

Examine out these numbers: When you math it all out, you're paying at least $530 a night to go to the exact same location every year for ten years! That's not even thinking about the maintenance fees going up each year and all those other unforeseen expenses we mentioned previously - what to do with a timeshare when the owner dies. And if you financed it with the timeshare business, the nighttime cost might easily get up to $879 a night! Yikes! Dave Ramsey says you get absolutely nothing out of paying for a timeshare other than the loss of choices and the loss of your money. Timeshares are seriously an awful usage of your cash! So, what can you do rather? Dave says, "Timeshares are basically getting you to prepay your hotel bill for twenty years.

This just implies making routine deposits gradually in a separate fund that then includes up to a big piece of change you can use to go anywhere you 'd like. Or keep in mind the numbers we ran through earlier? What if you took your initial financial investment of $22,000 plus the first year's maintenance fees (amounting to $22,980) and put that into a fund with 10% interest? With that simple financial investment, you 'd create a perpetual fund making practically $2,300 in interest every year to use for holiday! And after that next year, you can go back to the exact same place or (here's an insane idea) somewhere you've never ever been previously.

Timeshares get a lot of criticism due to their associated costs. There are some upfront charges and continuous charges that can make them more pricey than paying for a week's lease in a villa. However, timeshares likewise cost less than acquiring a second home, so many people continue to back up them. Regardless of where the expenses come from, the charges can include up quickly and alter without warning. Here are a few of the expenses that potential timeshare buyers ought to understand. Just like all things property, place matters. For that reason, a timeshare in Orlando, Florida, can easily cost at least $20,000, however less-desirable areas might not reach that cost.

Other costs to be knowledgeable about are any funding charges and interest. Neither banks nor non-bank home mortgage lenders will finance timeshares. For that reason, unless the purchase price for the timeshare is paid in cash, funding will originate from the timeshare developer at a high premium. While some prospective owners may deduct the interest that they pay on their financing payments, many will not. If you are considering a timeshare, you should inspect with your tax consultant for more information about the possible tax benefits. In addition to in advance costs and funding, timeshare owners can expect to pay charges throughout the life of their timeshare ownership.

Top Guidelines Of What Is The Up-front Cost To Purchase A Timeshare

Timeshare designers frequently hire brand-new management teams once they fulfill their sales targets. These brand-new groups can change the monthly fees and the level of service provided at their discretion. Finally, there might be service charges related to owning a timeshare. For example, vacation planning costs that owners sustain each time they book a timeshare. Furthermore, there might be point charges for carrying points over to another year or utilizing them with an affiliate location. Before buying a timeshare, possible buyers must take the time to comprehend what service fee they may incur and just how much versatility they will have as an outcome.

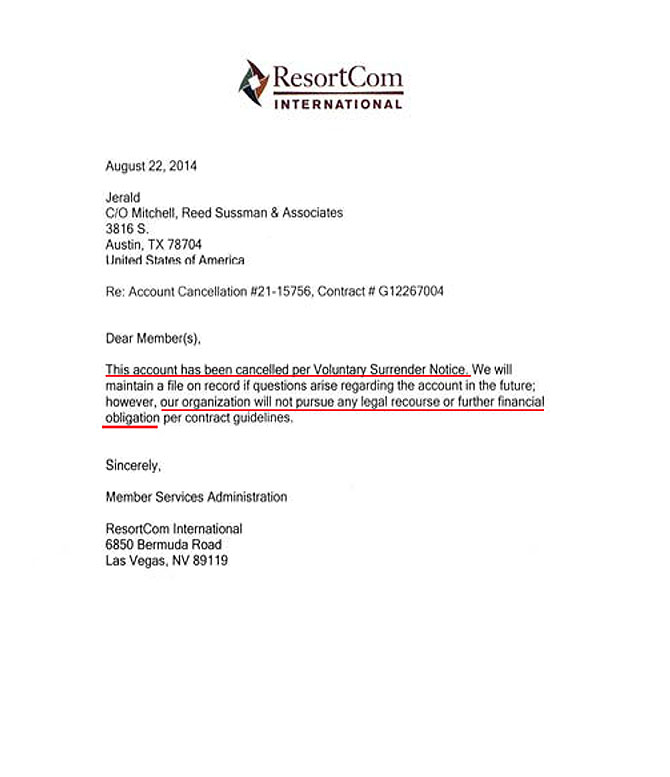

You've concerned fear viewing the money drain out of your checking account when your timeshare payments and maintenance costs are due. At this point, the resort resembles a rude guest consuming all the food at a partyand they never ever get the tip that you're ill of them. what percentage of people cancel timeshare after buying?. Maybe it wasn't always like this. Perhaps you utilized to enjoy your timeshare prior to the kids grew up, your partner got ill or your finances changed. Or perhaps you recognized it was an awful mistake the day after you signed the papers. Whatever the case, now you feel caught. And https://www.timesharetales.com/blog/best-timeshare-cancellation-company/ much like 85% of timeshare owners, you're wondering, How can I get rid of my timeshare? $11 Timeshare cancellation can be a bit tricky, however there are ways to get out.